As the April 15, 2025, deadline draws near, millions of Americans are running out of time to claim their IRS stimulus checks. This final chance to claim the third round of Economic Impact Payments, issued as part of the American Rescue Plan, is fast approaching. The $1,400 Recovery Rebate Credit can significantly reduce the amount of tax owed or increase your refund, but if you miss the deadline, you will lose out on this potential financial benefit.

What Is the Recovery Rebate Credit?

The Recovery Rebate Credit is essentially the final opportunity for individuals who didn’t receive, or did not receive the full amount of, the third round of stimulus payments. This payment was originally issued in 2021, and if you are eligible but missed the payment or received an incorrect amount, you can still claim the credit when filing your 2021 tax return.

The credit can be up to $1,400 per eligible individual and is also available for dependents. This includes children, but the important distinction here is that for this credit, the definition of “dependents” is broader than it was for earlier rounds. You can claim the credit for children, adult dependents, and other qualifying individuals.

Who Is Eligible?

Eligibility for the Recovery Rebate Credit is based on your 2021 tax return. The following are key criteria to help determine if you qualify:

- Income Limits: Individuals who earned up to $75,000, heads of households earning up to $112,500, and married couples filing jointly with incomes up to $150,000 are eligible for the full $1,400 stimulus. There is a sliding scale for those with incomes above these limits.

- Dependents: You can claim the credit for all qualifying dependents, not just children under the age of 17.

- Non-Filers: Even individuals with little or no income may qualify, so it’s important to file a return if you didn’t receive your stimulus payment in 2021.

How to Claim the Stimulus Check?

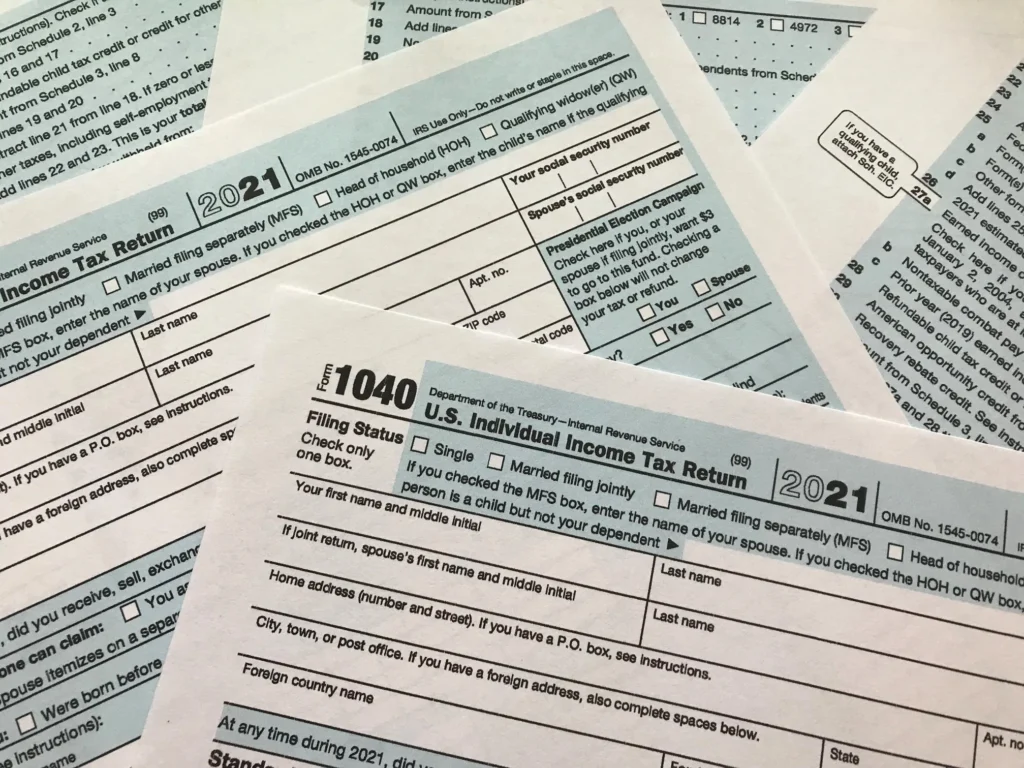

If you didn’t receive the full amount of your stimulus payment in 2021, you can claim the Recovery Rebate Credit when filing your 2021 tax return. This applies to anyone who filed but didn’t receive their full payment, or if the IRS made a mistake and underpaid you. You will need to use IRS Form 1040 or 1040-SR to file your return.

- Review IRS Letter 6475: This letter was sent to individuals who received their third stimulus payment. It includes the amount you were sent, which will help you determine if you need to claim the credit.

- File a Tax Return: If you haven’t filed your 2021 tax return, this is your opportunity to do so. If you filed already and missed the credit, you can amend your return using IRS Form 1040-X.

- Non-Filers: If you didn’t have to file a tax return in 2021 due to low income, you still may be eligible. Non-filers can use the IRS Free File tool to submit a simple tax return for this purpose.

Why It’s Important to File by April 15, 2025

April 15, 2025, marks the final deadline to claim the Recovery Rebate Credit. After this date, you will no longer be able to file a claim for the $1,400 payment. So if you are eligible, it is crucial to act quickly and file your return or amend it by the deadline.

For those who need more time to file their tax returns, the IRS offers an automatic extension. You can file for an extension using Form 4868, which gives you until October 15, 2025, to submit your return. However, you still need to claim the credit by the April 15 deadline if you want to receive the benefit.

Additional Credits and Benefits

In addition to the Recovery Rebate Credit, eligible individuals may also qualify for other tax benefits, such as the Earned Income Tax Credit (EITC). The EITC can provide up to $7,830 for qualifying individuals, depending on their income and family size. This credit can also help reduce your taxes owed or increase your refund. For further details on EITC eligibility, visit the IRS website’s EITC page.

Filing Assistance and Resources

If you need help filing your tax return or understanding if you’re eligible for the credit, the IRS offers several resources:

- IRS Free File Tool: For eligible individuals, the IRS offers free filing services through the IRS Free File program.

- Tax Filing Services: If you’re unable to file on your own, consider using a trusted tax professional or online tax preparation services.

- IRS Contact Information: For direct assistance, visit the IRS website or call their help center.

Final Thoughts

The Recovery Rebate Credit represents a significant opportunity for many Americans who are eligible but haven’t claimed the $1,400 stimulus payment. With the April 15 deadline quickly approaching, it is crucial to file your tax return as soon as possible to ensure that you don’t miss out on this financial aid. The IRS has made it easier than ever to claim the credit, so don’t delay—file today and maximize your potential refund.

This article has been carefully fact-checked by our editorial team to ensure accuracy and eliminate any misleading information. We are committed to maintaining the highest standards of integrity in our content.

Himanshu Sharma writes for Weekend Spy, focusing on recruitment, government schemes, and current affairs. He is dedicated to making complex information accessible to readers.

Himanshu enjoys playing chess, hiking, and trying new recipes, always seeking ways to combine his love for writing with his passion for exploration. Connect with Drop him an email at [email protected].